unemployment tax refund updates today

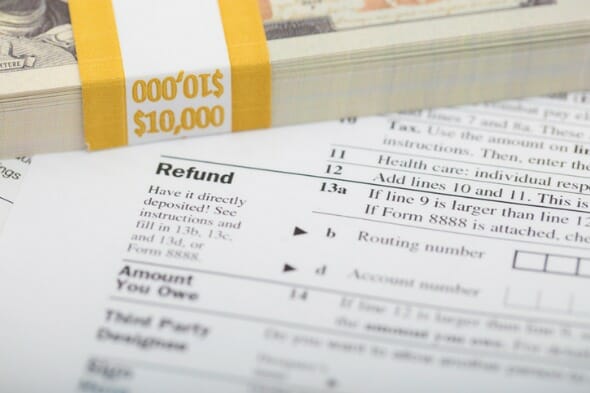

IR-2021-159 July 28 2021. Most recently the IRS issued a batch of refunds for taxes on unemployment income to almost 4 million.

Irs Announces It Will Automatically Correct Tax Returns For Unemployment Tax Breaks

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the.

/cloudfront-us-east-1.images.arcpublishing.com/gray/4MOYBEDSEFCGTJHUEM73A3QU3Y.jpg)

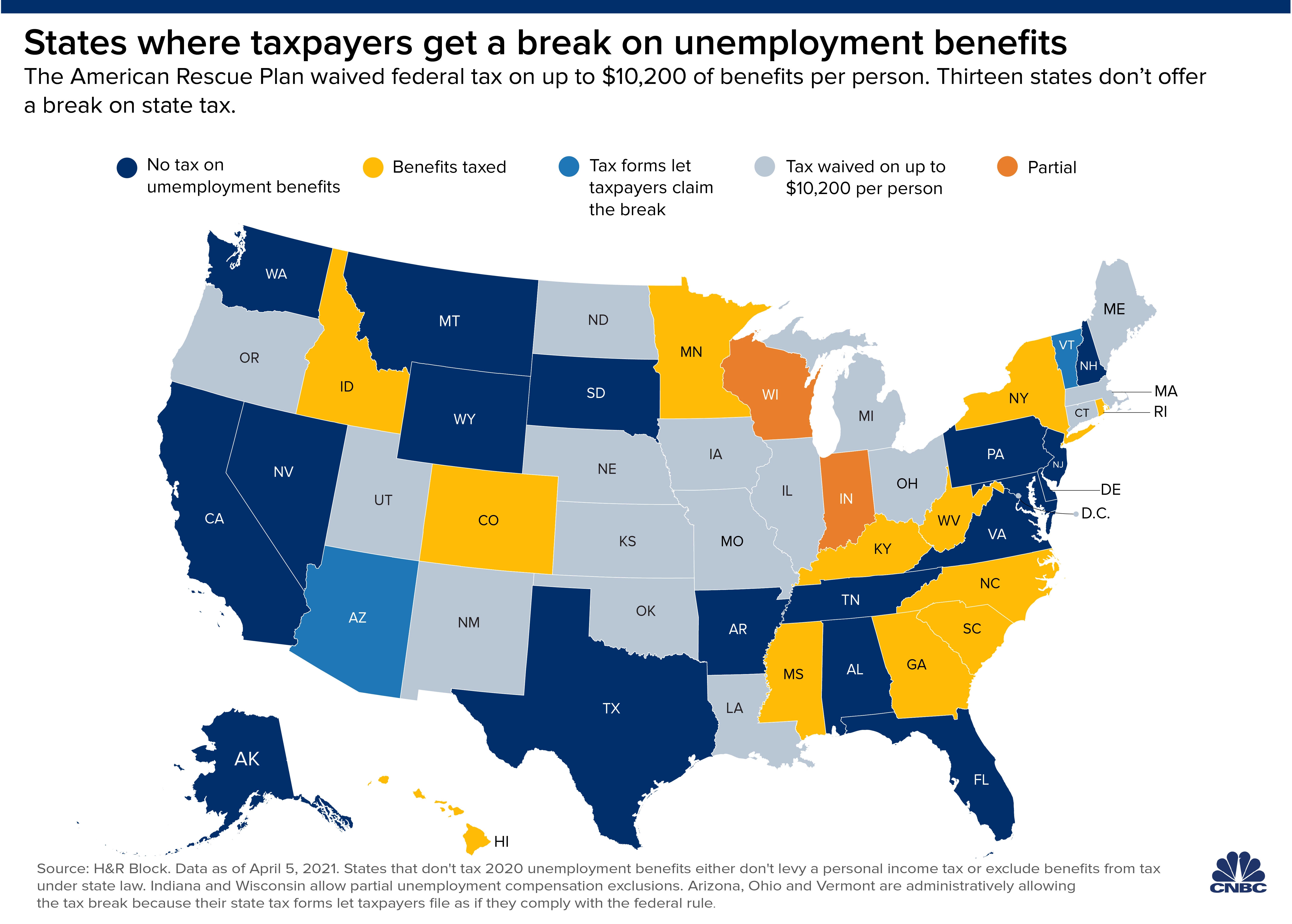

. But that doesnt mean the couple as a tax unit always gets tax waived on double the amount. THE IRS is now sending 10200 refunds to millions of Americans who have paid unemployment taxes. One of the lesser-known provisions of the 19 trillion American Rescue Plan was a substantial tax break for recipients of unemployment benefits which offers a considerable.

T he IRS is continuing with its post COVID-19 initiatives and the unemployment refunds. But since the bill was signed into. The Internal Revenue Service updated its frequently asked questions page Wednesday with new and updated information about the exclusion provided under the.

25082021 - 1225. The American Rescue Plan Act of 2021 which became law in. The American Rescue Plan exempted 10200 of unemployment income from federal taxes for those who earned under 150000 in 2020.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. Irs Sends 430000 Additional Tax Refunds Over Unemployment Benefits. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

4th Stimulus Check Update. The unemployment tax refund is only for those filing individually. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust.

Around 10million people may be getting a payout if they filed their tax. Americans who overpaid taxes on unemployment benefits this year will start to receive refunds this week the Internal Revenue Service announced Friday. Checks are coming to these States.

Each spouse is entitled to exclude up to 10200 of benefits from federal tax. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

Tax Refund Whiplash Pandemic Perks Give Some A Windfall Others A Bill Politico

Tax Refund Unemployment Update Tax Loophole Explained By Cpa Youtube

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

Irs Still Sending Unemployment Tax Refunds

Tax Refund Delay What To Do And Who To Contact Smartasset

Is Unemployment Taxed H R Block

States Seek Amended Tax Returns For 10 200 Unemployment Tax Refunds

Irs Unemployment Tax Refunds Next Batch Of Checks Timeline

Irs Unemployment Tax Refund Timeline For September Checks

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Irs Transcripts Updated With Unemployment Tax Refund Date R Irs

Irs Refund 2021 Will I Get An Unemployment Tax Check

Where S My Refund 2020 2021 Tax Refund Stimulus Updates What Do I Suppose To Be Looking At For The Unemployment Tax Refund Facebook

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

/do0bihdskp9dy.cloudfront.net/08-16-2021/t_16d2bdaea752464ba461e97da4586a14_name_t_2da645698e8740ac9bdbc41b3b786af0_name_file_1920x1080_5400_v4_.jpg)